So I just want to make sure I understand things–is it the received wisdom that the Republicans are fiscally conservative, and the Democrats are the ones who spend money they don’t have?

Interesting.

Over at Calculated Risk there’s some posting going on about the US National debt:

The US Treasury Department reports that the US National Debt increased $553.7 Billion in fiscal 2005 (ends Sept 30, 2005).

The total National Debt is now $7,932,709,661,723.50.

That number is pretty much inconceivable, right? I mean to pay that off you’d have to have eight million people each give a million dollars.

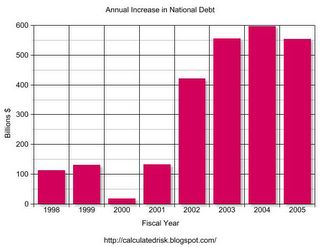

Now, here’s an interesting chart, also stolen from that same post that you could do a little partisan analysis on:

Oh, and “The initial estimates for fiscal 2006 are for a new record of approximately $650 Billion in new debt.” I think that was before the hurricane recovery money. That graph shows a definite pattern, but not one I’d call “fiscally conservative”.

This is one clear symptom of a series of problems that are, in fact, obvious to the rest of the world. You can see the consequences of this international opinion in the value of the US dollar.

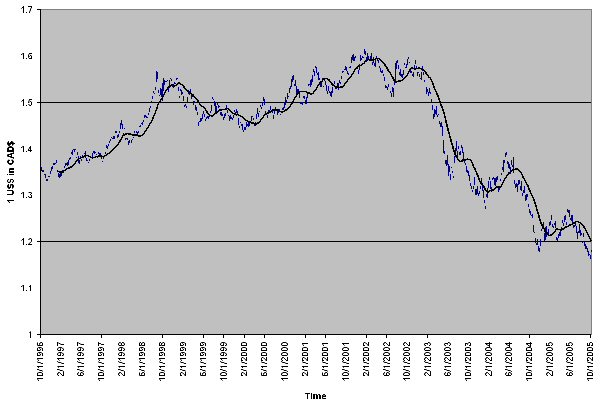

I’ve pulled down around nine years of daily US$-CAD$ exchange rates to use to illustrate this. I bet the EURO charts would show the same pattern, maybe moreso since the EU economy isn’t as tightly coupled to the US as ours is.

Here’s the value of the US dollar over time, against Canadian. Apparently the deeper we get into Bush’s reign, the less world currency markets think the US dollar is worth compared to Canadian. The black line is a 100 day moving average. (It’s easier to read if you click through to the full size version).

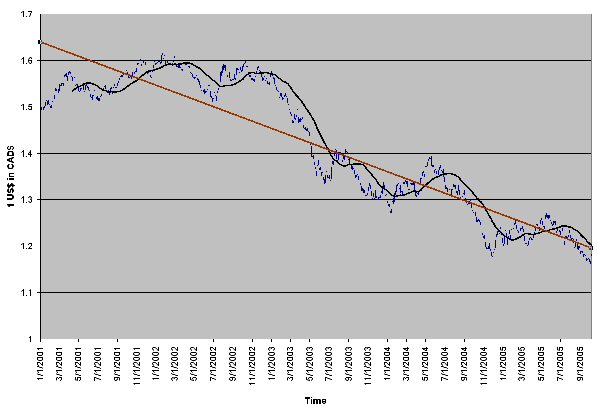

Now, let me make my point more simply: here’s the section of that chart that reflects Bush’s term in office. The red line represents the linear regression of the data.

(Incidentally, if you extrapolate from that linear regression, the US and Canadian dollars reach parity sometime in 2007.)

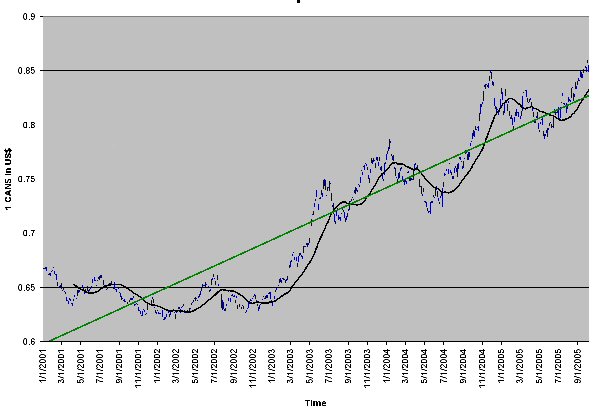

Of course, rather than think of it that way, I prefer to look at it the other way.

As the US dollar falls against the Canadian, the Canadian (obviously) rises relative to the US. That means that while my salary (which is fixed in CAN$) doesn’t change, my buying power for things priced in US dollars (like books!) increases. So, I guess you could say that the Bush administration policies have effectively given me a 50% raise as far as buying books goes.

Still, looking at the slope on those lines, I’d be pretty slow to refer to the policies as “fiscally conservative”